Carvana bankruptcies have been a hot topic lately. Many people are wondering if this car-selling giant will declare bankruptcy after facing some big money problems. Even though Carvana has made some changes, it’s important to understand what’s really going on.

Recently, Carvana worked hard to fix its debts and has not gone bankrupt yet. They even surprised everyone by making a profit! This is a good sign, but some worries still linger about their future and if they might face more bankruptcy troubles.

What Are Carvana Bankruptcies?

Carvana bankruptcies refer to the possibility of the car-selling company going broke. This means they may not have enough money to pay their bills. When a company files for bankruptcy, it usually tries to reorganize its debts. This helps them stay in business, but it can also cause big changes.

People are worried about these bankruptcies because Carvana is a popular place to buy cars online. If they go bankrupt, many customers might be affected. This is important to understand as it can change how people shop for cars in the future.

The Reasons Behind Carvana Bankruptcies

Several reasons could lead to Carvana bankruptcies. One major issue is the company’s high debt. They borrowed a lot of money to grow quickly, but paying it back has been tough. With rising interest rates, their debts are becoming even harder to manage.

Another reason is the changing car market. Many people are looking for cheaper cars or different buying options. If Carvana cannot keep up with these changes, they might struggle to sell enough cars to stay afloat. Understanding these factors is key to seeing why the company is in trouble.

How Carvana Is Trying to Avoid Bankruptcies

To prevent bankruptcies, Carvana has been taking action. They restructured their debts, which means they made new agreements with lenders to reduce what they owe. This step helped them lower their overall debt by a lot. Such actions give them breathing room to operate better.

Carvana is also focusing on improving its business. They want to sell more cars online and make the buying process easier for customers. By doing this, they hope to attract more buyers and boost their sales. This strategy is essential in their battle against potential bankruptcy.

The Impact of Carvana Bankruptcies on Customers

If Carvana goes bankrupt, it could affect customers in many ways. For instance, there might be delays in getting cars they ordered. This could be frustrating for people who are eager to get their new vehicles.

Additionally, warranties and services might be at risk. Customers rely on these for protection after buying a car. If the company faces bankruptcy, these services may not be honored, leaving customers in a tough spot.

Shareholders and Carvana Bankruptcies: What to Expect

Shareholders are people who own parts of Carvana. They could face big problems if the company files for bankruptcy. Typically, when a company goes bankrupt, its stock prices drop significantly. This can lead to losses for investors who were hoping to earn money.

Many shareholders might feel anxious as they watch the company struggle. They could lose faith in Carvana’s ability to bounce back. It’s essential for them to keep an eye on how the company manages its financial issues in the future.

Carvana Bankruptcies and Its Effect on Employees

Employees may also feel the impact of Carvana bankruptcies. If the company struggles, it could lead to layoffs. Losing jobs is always a tough situation, and many workers worry about their futures in such cases.

Moreover, the workplace environment might change if there are financial troubles. Employees may have to deal with less support or resources. This could make their jobs more challenging, and morale might suffer as a result.

Understanding Carvana’s Financial Changes

Recently, Carvana made some financial changes that aim to keep them out of bankruptcy. They worked hard to restructure their debts and lower their financial burdens. These changes have helped them see some success, but challenges still remain.

Understanding these financial shifts is essential for everyone involved. Customers, employees, and shareholders all want to know if Carvana can turn things around. Keeping track of their progress is important for making informed decisions.

Signs That Could Indicate Carvana Bankruptcies

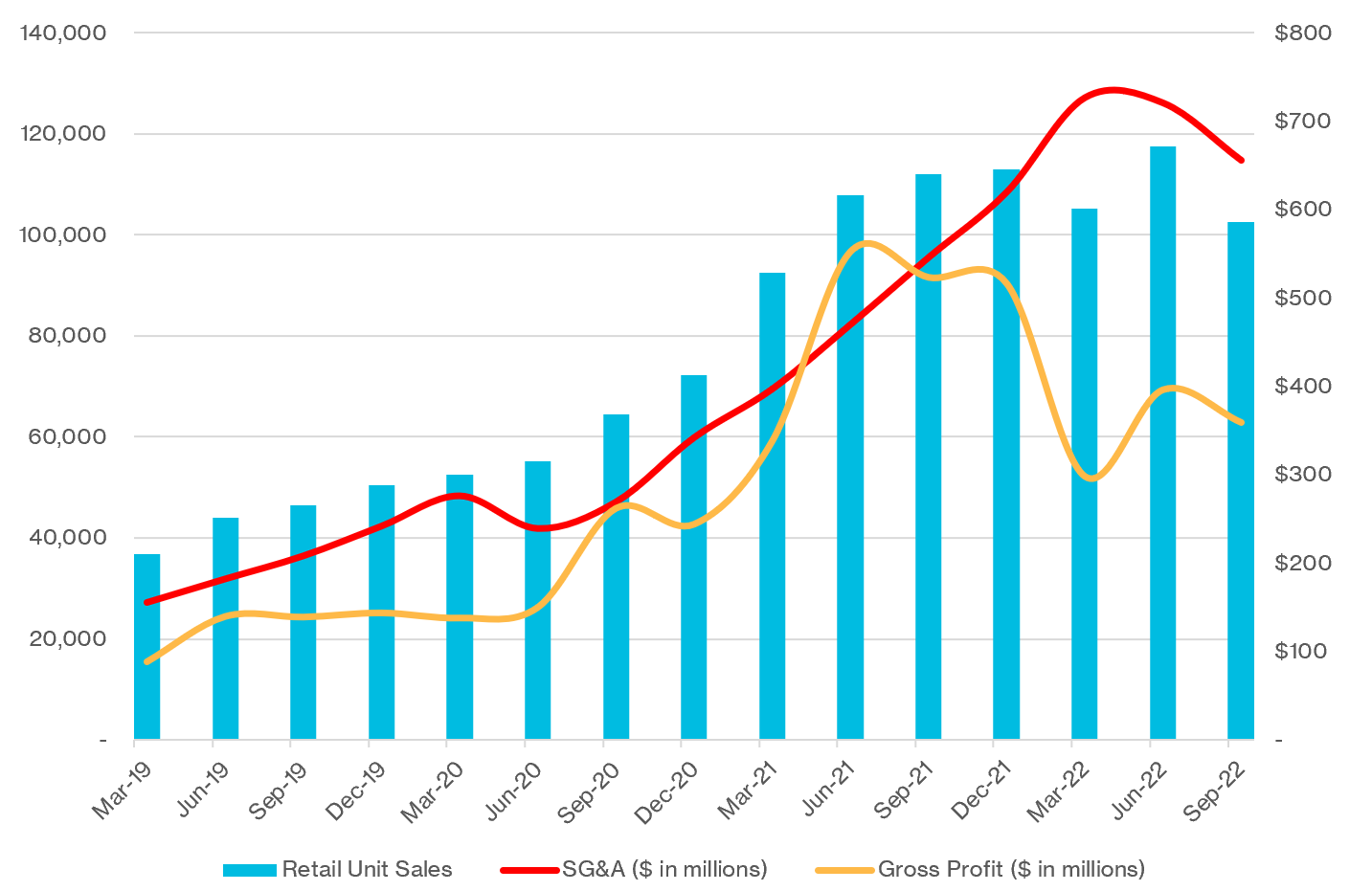

There are some warning signs that could indicate Carvana might face bankruptcies. If sales numbers drop or expenses rise sharply, it could signal trouble ahead. These signs are crucial for investors and customers to watch.

Another red flag is the company’s ability to pay its bills on time. If they struggle to meet payment deadlines, it can create further financial issues. Awareness of these signs can help everyone stay informed about the company’s health.

Comparing Carvana Bankruptcies to Other Companies

Comparing Carvana bankruptcies to other companies can help understand their situation better. Many businesses face financial issues, especially in tough economic times. Learning from their experiences can provide valuable insights.

For instance, some companies have successfully navigated bankruptcy by restructuring their debts. They emerge stronger by focusing on their core business and improving customer service. Carvana can look at these examples to find ways to avoid going under.

What Happens to Warranties If Carvana Goes Bankrupt?

Warranties are important for customers, but they might be at risk if Carvana files for bankruptcy. Warranties offer protection for car buyers, covering repairs and services. If the company cannot honor these agreements, customers may feel insecure.

This uncertainty can lead to a loss of trust in Carvana’s services. Customers may hesitate to purchase cars if they think their warranties won’t be honored. It’s vital for Carvana to address these concerns to maintain customer confidence.

Future Outlook: Can Carvana Avoid Bankruptcies?

The future outlook for Carvana depends on how well they manage their business. If they continue to improve their sales and reduce costs, they have a better chance of avoiding bankruptcy. Keeping a close eye on their financial health is crucial for everyone involved.

Investors and customers should stay informed about Carvana’s progress. Success in their recovery efforts can lead to a brighter future. However, ongoing challenges in the market mean they need to stay on their toes.

Tips for Customers During Carvana Bankruptcies Concerns

For customers worried about Carvana bankruptcies, there are some helpful tips. First, stay informed about the company’s news and financial updates. This can help you understand any changes that may affect your purchases.

Second, consider your warranty options carefully. If you buy a car, make sure you know what’s covered. Being aware of the situation can help you make smart decisions when buying a car.

Conclusion:

In conclusion, Carvana bankruptcies are a big topic that many people are talking about. The company has faced many challenges, like high debt and changes in the car market. However, they are trying hard to make things better by restructuring their debts and improving sales. It’s important for everyone, especially customers and investors, to keep an eye on how the company is doing.

As Carvana works to avoid bankruptcy, they need to focus on serving their customers well. If they can keep selling cars and providing good service, they might just find a way to succeed. Staying informed about Carvana’s progress will help everyone understand the future of this popular car-selling company.